80 week cycle might not be finished on Nasdaq

Points to bears being in control on fundamental interaction (bank failure)

I think the main thing we need to focus on is if the market stabilizes next week, then dives again. This would be the continuance of the 80 week equity cycle down.

The last trade that I posted from two Friday's ago, was a long based on the bottoming then the break above action signals last week (20 day VTL) and it was a good one.

Shorts will enter the market immediately Monday and try to press lower due to the failure of the last 20 day cycle. And to test liquidity based on fundamental interaction last week.

This means, that there could be a larger trough ahead next week. Perhaps it takes 2 weeks.. who knows! Its all up to this 80 week cycle’s ideas for where it wants to terminate.

The reason is: when the 80 week cycle turns down hard, like now… it LENGTHENS in time period. So its not unlikely we can see a huge move to the bottom of the daily range!

… Before it will turn up again!

The last 80 week cycle trough on Nasdaq is understood by analysts to be October 2021.

So thats 17 months duration.

This SHOULD BE THE LAST MOVE DOWN on this fundamental interaction created by the bank failure.

Then bulls will come back on data release news in the weeks ahead.

Be patient, the world is not well, but the opportunity will come in the form of a double bottom on the daily chart. If youre a swing trader, wait for this double bottom to occur over the course of 5 to 7 trading days, and then go with momentum.

Because that SHOULD be the bottom for the many months ahead, until bears come back to push the market lower, later in the year.

Edit Mar 14 1011 CST

Market appears to reform its major trough. Watch for double bottom to occur intraday for the next few trading days to get into large trough formation.

You will see major players enter and leave back and forth until behaviorally, everyone jumps on.

Be patient, but as you know Ive already been trading this impulse as of last week. I thinm the fundamentals coincide with time and volume to indicate a major rally forming ahead.

You heard it here.

Dont miss a post!

Edit Mar 15 1334 CST

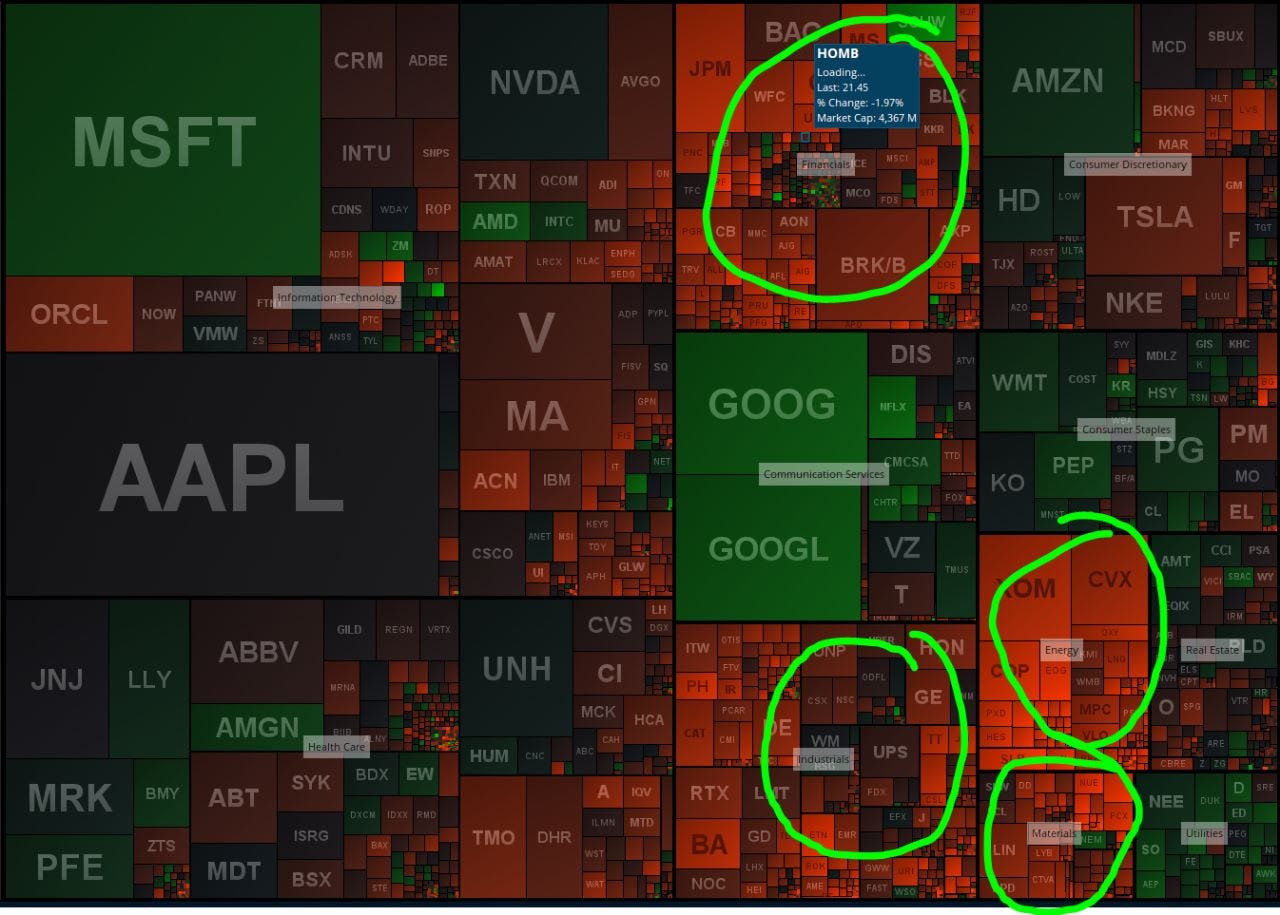

Market has suffered a rout in financials, energy, materials and industrials.

Tech has lifted SPY 0.00%↑ but its expected to fail if larger players dont come in soon on the buyside.

Dont miss a post