Advised #10

Hi this is Derek Frazier and this is Advised Trader’s weekly newsletter where I take someone new to cyclical trading, and attempt to gently pat their head and rub their back as they slowly turn the addiction to mis(mal)information off.

Timeline of events in this recent bear market that started on March 30th

~SHOWN BELOW~

~AND THE RESULT~

What is mis(mal)information?

Its an attempt to establish a trusting relationship with a target (you the investor/trader) when there is no real need or informed decision to trust, but subconsciously the gift of trust is bestowed on the misinformer when it is actually ill placed.

OUCH …“Relief Rally Hopers April to May 2022” Market denial or calculated mean reversion decision by pro traders?

The last few months and even today, “persons” are buying stocks. This means that they are hoping for a relief rally, and are prepared to hold a little longer. Unfortunately this is not wise. They are going to be hurt pretty bad with a self-inflicted market wound. I believe that the 80 day cycle is or has failed on equities. This means indexes are going down further before a rally. Of course the relief rally will come randomly, and it will be large, but not large enough to offset losses incurred by these “relief rally hopers”.

SAY IT AGAIN DEREK:

Of course the relief rally will come randomly, and it will be large, but not large enough to offset losses incurred by these “relief rally hopers”

So the pros got it wrong. Had they been trading with cyclical trading, they would have known that things were getting very bearish as far back as March 30th where I started to see the selloff start on $NQ, and issued 2 shorts watchlists... then the next day I thought $BABA was going to have a major failure due to its recent weakness.. It fell well.. AND then again on April 5 when a target was missed on #NASDAQ. I issued newsletters on the 5th and two on the 6th: 1 and 2. Topped off the week with an accurate review. Further helping readers, I made the comment that Equities should stair step down.

You were late to the selloff. I understand you were not thinking about cycles.

But surely you caught the 40 day cycle failure and watched the video where i explained how to trade a buy trap in equities. Buy traps exist in bear markets and they serve a purpose. They help you stop deluding yourself and trading into a longer term trough that is much lower than thought beforehand. Surely when I say 10000 Nasdaq your ears perk up and you read the post? The target on $NQ is 11500. I said this on April 26th. My words aren't light, the reason I used this is to wake people up to the bearishness. And maybe they would see buying as faulty in cyclical logic both in the short and long term.

OKAY I GET IT, you WERE ON VACATION or WHATEVER… BUT SURELY you caught the shorts from last week?

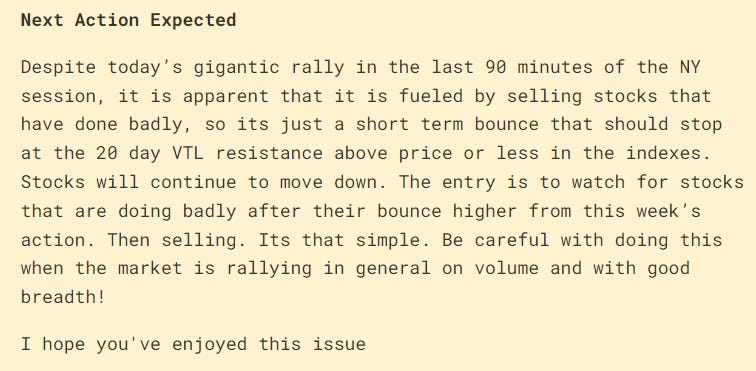

~SHOWN BELOW~

And finally did you miss this week’s watchlist? I hope you didn't.

~SHOWN BELOW~

These were minus… minus alot.

BIG WINS

These are big wins for Advised Traders, and to witness this evidence and review it for the record books but DO NOTHING TO CHANGE YOUR THINKING, is great folly by the reader. You seen the general market and then you were able to discern that something was not right for the buyer case. Weeks or months before others. All because of cyclical trading… Use this time to reflect and be awed by cyclical trading.

It wasn’t me, it was just me reading the cycles to TEACH YOU. I think you should join as a paid member and start to buy into the art and science that Ive presented to you over JUST 10 ISSUEs of Advised Trader. 10 emails… 👀 OR pay it forward and gift subscriptions to someone you care about… But Id like to work with you full time on this in the future, and for us to get together on this to build a team as I roll out my first program to traders soon.

So Derek What is next in the financial markets?

….Probably a failed 80-day cycle rally… The market is so bearish it is heading to larger targets below, probably the 80 week FLD projection. From there a big rally, but it will be impossible to try to trade it without intense focus. So I hope to focus when I see it.

But for now, it is becoming a total failure of the 80 day trough and will carry price down to lower levels on the indexes.

There could be a relief rally, but stocks are expected to see their 40 week cycle trough in LATE July, which is a long way away

Semiconductor 40 day peak on $AMD and 20-week peek on other semiconductor stocks

I wish I posted this yesterday, but I wanted to save it for you. $AMD is suffering from a recent 40 day peak and semiconductors are having a 20 week peak. They were artificially stood up by investors that were frontrunning whatever it is that they frontrun… in their minds… And now they will liquidate. The short target is $62.50 for a measured move down.

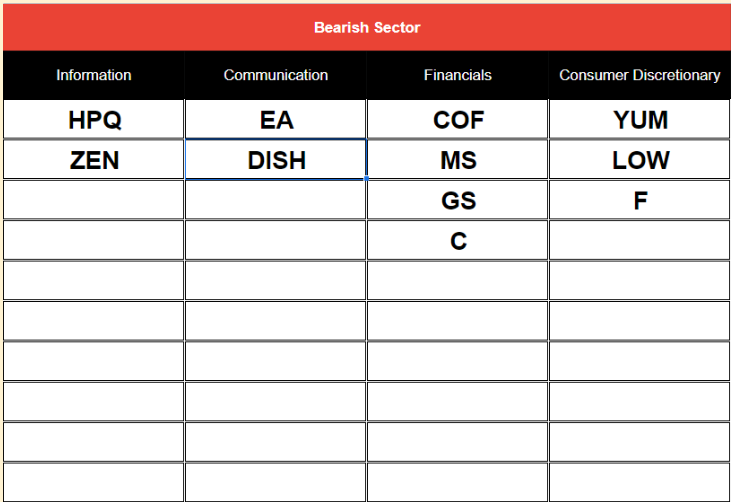

Short tactic is watch for over inflated stocks wrong footed safety stocks and capitulation

I think it's safe to start looking at mispriced stocks that are “safety, dividend” and stocks like that and seeing if they're having trouble making cyclical targets, and the general market rolls over again next week, and they all get hit with big losses.

Preferred Entry on These types of cyclical failures

Entries are on volume below the pre-market and at resistance on the hourly highs with absorption.

Financials are finally breaking down

Meaning more down, and if they get hit really hard, then that will signal that there is a limit down coming.

TRADE IDEA: Cycles Meet Fundamentals; the 54 Month Cycle on /6M trade of 2022

Occasionally I have an idea. I will now give a long term trade based on fundamentals with cyclical entry and exit.

Despite everything that has happened in the last 6 years to other currencies… The Mexican Peso is strong….ITS AT THE SAME SPOT IT WAS 6 YEARS AGO!

I thought it would be also good to add a fundamental aspect to the trade: It has to do with federal legalization in North America. The supreme court's ruling on less strict marijuana possession to allow police to worry about other things. This means Mexicans see Marijuana as an alleviating drug and will adopt better inclusion into the formulary soon. GDP will be going up. It also means that the peso will remain strong and lets now look at the cycles:

9 year VALID TREND LINE above price at .05, with the strength of the peso, and the bettering of the economy and more retirees and real estate investments, etc.. the Mexican peso should stay strong with the dollar, and may even break out of that 9 year VTL to the upside producing a 10 to 25% move over 2 years (9 year FLD projection).

Investors may have to wait for June or July as the Peso rattles towards its 40 week cycle trough

Buying early may save a lot of margin and risk to reward is better with stop below November 2021, or no stop at all

And there was a lot of trading in 2015 at .06350 which is 25% above price.

All this while the $DXY dollar index has made new highs this week.

The Peso remains immovable

Foreigners are investing

*transaction has types of weird risks, that favor not trading it, but I thought it was a good one to see the 54 month cycle pushing up so hard on the dollar by a currency..

~SHOWN BELOW~

~AND THE WEEKLY CHART SHOWN BELOW~

…… Good luck with the Peso Trade

Additional Peripheral Comments:

Worst time to buy real estate is buying from rich snobs with big wallets

affordability of 30 year loan at above 5.5 %

Helping snobs cash out? NO!

NO inventory: you should see these houses coming on the market in NA, its the houses from halloween movies on farms with snow and just beautiful places for investors etc, but still, not even remotely interesting for 95% of families.

Failure of market could happen soon

Patience and preparation with cash is key to finding a foreclosure in 2023-2025

I do hope you've enjoyed Advised #10, it will be a great source of learning. Won't you subscribe for FREE if you haven't? It helps if you share as well. Im sure people care about this material, and will be happy that you referred them to the newsletter!

####