Advised #3: Three tools and three steps to save your trading career

So I have this pain radar that guides my trading...

In this issue of Advised, I continue to talk about how to prove yourself to… yourself. To actually dig in and try to work hard, become better and assume you will in the process.

I share a story about my life and how I have a “Pain radar”. This is going to be an important issue for those struggling with making it in trading. Its not just about working harder and doing repetitive, boring and dedicated work.

I also share 3 Tools and 3 Steps to working smarter and with longevity so that one can obtain understanding and confidence in the markets.

Lastly, I update $TLT 30 year bonds and show a probable 80 day cycle setting up long for my readers!

No challenge. No struggles. No assertiveness. No journey. It's a shame living too easily!

These words are my idea about what it means to be human. At the end of your life, how much do you want to say you have struggled with things bigger than yourself? I cant stand when things are too easy. Its such a waste. I just don't think its a great idea to be passively walking through life so easily and without trying to dig in for one’s goals and help others. I hope this issue solves that problem for some readers. This one, odd way of thinking about life…has saved my ass more than once as I tried to navigate my surroundings. Basically my objective is to properly verify whether or not I am leading myself correctly. I do that by referencing how much pain I'm in at any one point or how much suffering I have had to endure or how hard it is to complete things. When I don't know whether or not I'm doing things correctly it's only because I'm not in enough pain. If it's too easy then I don't know what to do. That's my reality.

Thats my Pain Radar. That's the reality I pretty much created for myself out of survival.

I'm sitting in my room as a very young boy wondering where everyone is. I'm alone, slightly scared and probably abandoned once again. “Who’s coming to save me?” Noone came. For days and weeks it was my world.. I wasn't there for shits and giggles. I was there for survival. I was running hot on that for many years until I was constantly in the principal's office at school. They felt pretty bad for me, as they knew my situation. But there was this strong guy that took me and told me “it ain't gonna work on me, son”. He said “you're here to grow up”.

I continue to exist like this. The only thing is, I got a ton of help along the way. Just enough help from friends. Other soldiers. People… the opposite of my upbringing... Just with the patience to deal with me. For that I'm grateful. Still got that pain radar, though. I carry it around and can't fully relax unless it's at the beach, forest or somewhere real safe.

This helps me to this day, but is a sort of double edged sword. Keeps me awake, but keeps me too alert and I can't relax even when I'm supposed to. I have to figure that out..

But trading is good for this. I use it to resolve clues and use data to rehearse what I should be doing. I'm not paranoid. It’s why alot of champions from combat actually like trading. Not for the rush, but for the challenge and being able to get clues and acting on them to win. Real time detective work, with one's on psychology, other contestants and all with relatively no emotion.

I say this because I suspect that many of my readers may be coasting with their wins from the past year, the “bubble of all bubbles”.

They are scared now. The market has changed. They are brittle and without strategy, and they can't look for clues because things have been too easy. They're gonna suffer. Traders, please listen. The trading that you can do in a super bubble is different than when you're trading a cyclical market that we are entering.

Or maybe some readers are coasting due to a luxury lifestyle that they've lived.

Basically the purpose of all of my work is to try to figure out what I can do to make things easier for myself to understand and do it faster, and have confidence behind my decisions. I try to gain an edge in deciphering the market, continuously learning. And I have this multifactor framework to try to avoid pain while I'm trading. So to avoid this pain, I refer myself back to the following 3 steps to make sure I'm not regressing into bad behavior, and making things too easy on myself.

The 3 Steps I use to avoid pain being dealt to me by the market

If I can get on my soapbox for some readers that want to be more effective, and are struggling, I'll do so now: these are the things I think about to avoid the FREE pain being given by the market.

STEP ONE: It's acknowledging it's going to be a rough road and some days are worse than others. Some day my hypothesis doesn't work. Or I'm too inpatient. I also make mistakes. I don't think it means I'm a bad trader. I also don't think it's anyone's fault. Once I understand its not my fault or the market’s fault, I can go to step two.

STEP TWO: I remember that its always my responsibility, and my time to do the work, as a professional trader. I don't forget that I have to try to continuously be in the flow with the market at that minute… like it's combat. If I slip up or get lazy, even a minute sometimes, I will get laid flat and my account will get hit. Don't just enter a swing trade anywhere, try to examine with a top down approach, and wait for a major cyclic event to start happening or provide good evidence that your trade is going to continue in your preferred direction for at least an hour after the trade. If I feel it's not going to last an hour, I don't trade. It's simply 60/40 (the odds against me..) scalping at that point.

STEP THREE: After I've defined what level of success I want that day, I ask if the market seems like it will deliver, on a scale of 0 to 20, with 20 being it surely will give me what I want. A trend day, for example, at the beginning of a new 20 week trough like we've had in equities for 2 weeks, that is what I want to trade. A new large cycle trough like we had 16 March 2022. That was a healthy trending potential. A 20 is a scary thing, so the bigger the number, the better prepared one must be. Like the trend on $TSLA this week. That was a 20 out of 20. I think it was because it IS a safety stock (people feel they can throw money into it during volatility) as well as the market leader. And it made perfect sense in this environment, for alot of buyers to get in. Oh, the other things that are related to Step 3, are: Back testing, replaying, rehearsing, envisioning victory. All are necessary and can be done everyday when the market is closed.

This leads perfectly into the 3 tools framework that I use everyday and weekends too, to try to build my career in good habits and clear focus, that other people will want to engage with me on. Other traders can tell when I'm messed up. Its like a hidden dialogue.

The 3 Tools that I can't go without in my work

Here's the three tools that I use to do the work that I started in 2013, and full time since 2016.

After 2013, because of these 3 things, I began to get my “trading understanding”. It took me another 4 years after that, until 2017, to feel confident, and I started to really get to a confident place. I am continuously growing since then.

First and foremost: Cyclic analysis has brought me so much in terms of understanding and confidence in the market, than anything else. The whole foundation of the market’s willingness to cooperate with a trader is built upon his understanding of cyclical events and the tools to measure these events for timing and direction entries and exits. Believe it or not its not wishy washy. Its possible to use this type of analysis with fundamental research for medium time frame trading as well.

Cycles are pervasive and can be used on all time frames.

Secondly: Scans and thinking about which ones to employ based on the cyclic analysis I've conducted, help me to see what instrument to trade that day, as opposed to other days in the future. My analysis of future events isn't as important as the trading I can do today. Something that helps me stay focused is to have a bias for the day ahead, and then think of the scan to use to detect what to trade after I believe the bias is correct. I also think of an alternative when I'm wrong. Some days I don't do anything. But there is always something to trade. So, keep building scans around cyclic events with proper money management and time frames of all types.

Scans are algorithmic trading for the discretionary trader.

Thirdly: Journaling everything, through video, writing blogs and telling other traders about my work. This also includes reading articles and other traders’ work, as well as understanding how to interpret news for trading purposes. You will see an undercurrent of fundamental research in all my work.

Try to stay on top of the work required to stay pro, just as an athlete needs to research everything & workout effectively. It's no joke. Do they look like theyre playing “games”..?

The type of trader that wants to be a discretionary long and short trader with a short term time frame to find the best things to trade on a daily basis, should always be using these three tools. Without using them, I think one’s trading is going to be set back until they are thoroughly employed for years, over time.

I said it before I'll say it again: “Nothing can replace hard work”

That's where the journal comes in. I think without money management, good psychology and goals, there's not reason to trade in the first place. Because, it's frustrating to have two pieces of the puzzle figured out but then suffer with number three which is usually psychology right?

So here's a brief story on psychology! Sorry for the length of this newsletter. But it's important.

Importance of Monitoring Psychology

It's 2006 March. I'm standing in the woods in my BDUs inside camp Mackall, North Carolina and I've just been told that I haven't been selected for special forces. And I wouldn't be allowed to retry out. I had made a series of mistakes even before I came to the selection course but they said it was because of my amicably provided “shot group” that delineated all my faults and some of my strengths in terms of my participation in the course.

I think its just their way of saying goodbye, but nicely. I told the man I received it from, a Northrop Grumman contractor, probably a Vietnam vet, that I'd like to just go back to my hut and continue the next class, as I was just getting started, just warming up. Yes I was a beast physically. He told me “that's not how it works”, and that I had my chance. My world died. And the mythology that you once believed in, as it comes to an end so fast like this, at 25 years old, is emotionally and spiritually anesthetizing. Its the type of let down you feel all through your body.

It was very explicitly shown to me at this course that I needed to start taking more responsibility and recognizing weaknesses. BTW… One of those decisions that came from this is “listening to others”. I started getting help and I started listening much more after this disastrous defeat.

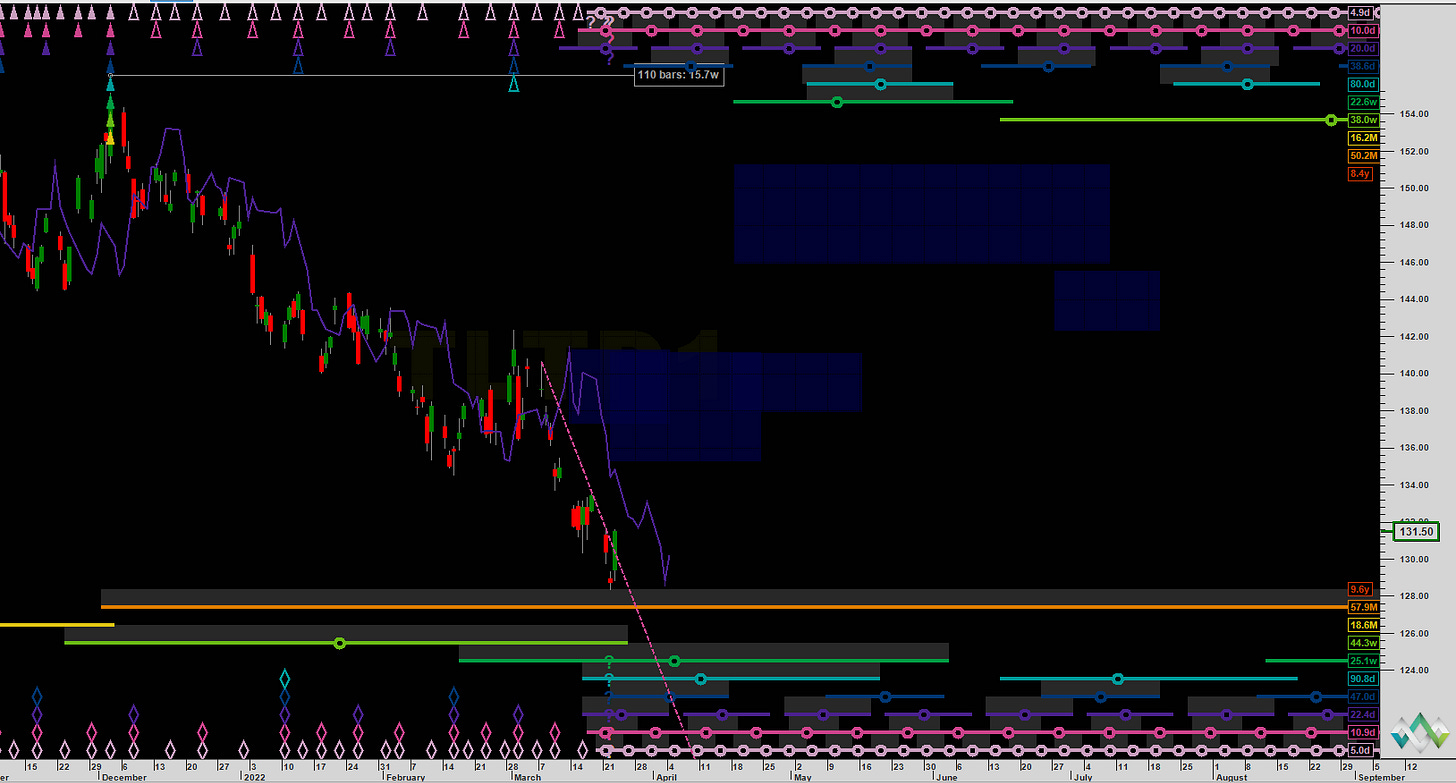

$TLT 30 year bonds setting up for a long out of 80 day cycle low

Wait for the VTL break (purple line) and go long!!!!

Its a validation that the 20 day cycle low is in when its broken by price…

Wrapping Up

There is a webinar that Im inviting all my readers to find out about an old, secret, hidden concept in trading that they've never known existed so they can:

Learn how to make their job easier

Find opportunities easier and faster

Use less risk and get accurate targets

Sincerely,

Derek William Frazier

Advised Trader

###