Advised #6

Hey this is Derek Frazier writing from Mexico City, bringing you another weekly edition of Advised. Where you can find absolutely zero spam and no affiliate link nonsense. Just some really good stuff to use in your trading.

The Final Trendline: Experience the thrill of seeing a cyclical trader’s arsenal in action!

Stocks making bearish posturing at their VTLs are getting ready for selloffs when the general market is bad or the sector that contains these instruments is having a bad day or week.

QUICK TIP: {A VTL is a “valid trend line”... Built off cyclical rules that only connect the bottoms of daily price bar formations that are proven spots of support... that, when broken by the median of a daily price bar, they can confirm peaks in the market of 10 to 80 day cycle magnitudes! WOW can you believe you're learning cyclical analysis!?}

Im going write up 3 to 5 stocks each week that have approached a very bearish place and are dangling off the edge of a really steep cliff and will produce an upcoming momentum trade in the next week. This means that with a {2.5},{5} or {10} day VTL, the stock can be expected to be very bearish in the week ahead. Draw the VTL yourself when you see a daily price chart for these stocks, and decide on whether the risk to reward is beneficial to you. It helps to confirm with the sector's strength and market breadth for the day. If the market confirms the short, it has a better chance of working. As with everything it's not black and white, so be careful.

Trading the move into the 40 day cycle low in US equities

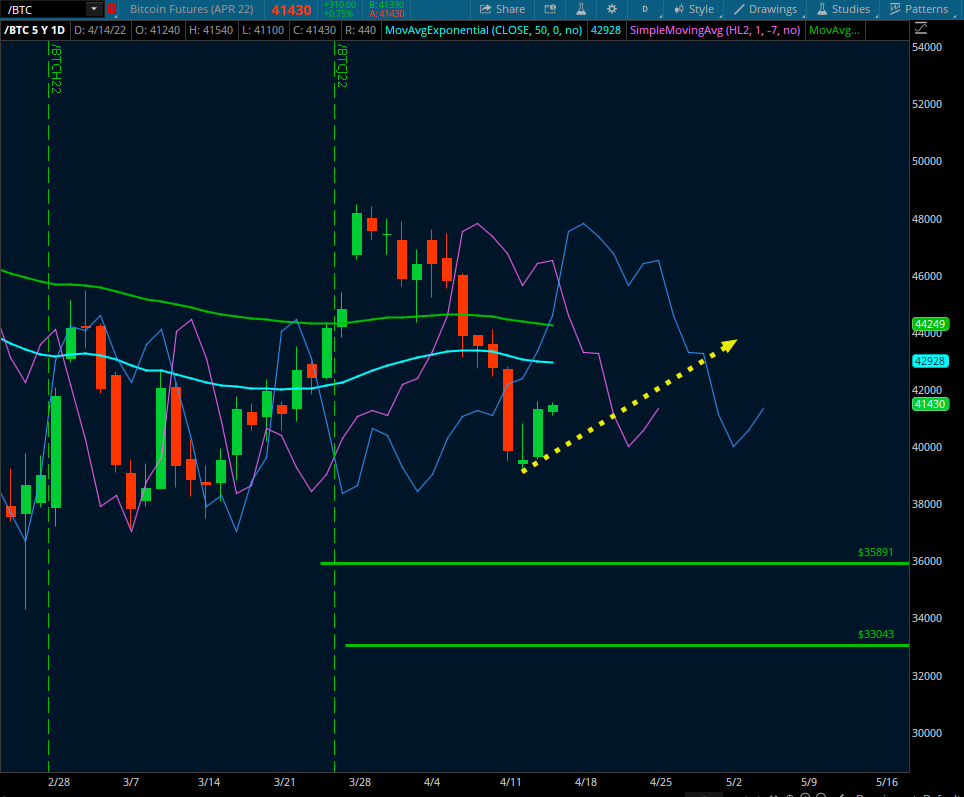

$BTC short

Connect the bottoms of this week’s daily low on a price chart with the bottom of daily price on this upcoming Friday, and over the weekend or next week, price should fall through to a target of $37500. This would be a 5 day VTL short trade. It connects the bottoms of prices that span a duration of 5 days. It will be invalidated on Tuesday night, and will not be a trade anymore. If this happens, draw a 10 day VTL and connect the longer duration bottoms of price on the chart. And that will be a strong short into the 40 day cycle low.

MHK 0.00%↑ short

is part of the home building supplier consumer discretionary sector. It is late into its 40 day cycle for $MHK. It may bounce off a supportive technical area formed from years ago. It was held up today on volume. If it continues to go lower into late week, AND the consumer discretionary and/or home builders sectors are down, then I think it continues lower to $116.

AVY 0.00%↑ SHORT

had large volume today. If that volume is pulled and turned into sellers on Friday or Monday, it could result in a wider selloff if the materials sector turns bad in the days ahead. The 5 day VTL is probably the best to use, or a 2.5 day VTL with today being a bullish day, there are probably buyers getting picked up. This adds to any down move in the week ahead. In the picture below, see the 20 day VTL that can be drawn today. If price breaks that, it will be a short trade to $165 area. However, prices may improve over the next few days and offer a 2.5 day steep VTL.

W 0.00%↑ short

will continue lower if another selloff in consumer discretionary starts next week. I will draw a 10 day VTL for this one. Currently, it is bouncing out of a 40 day cycle low. It may pick up buyers. It had a good day today. I am watching it for formation of the 10 day trough, low in the next 5 days. Possibly Tuesday it will fall through if the general market is bearish. It will break the 10 day VTL to the downside and continue to $100 of below.

KMX 0.00%↑ short

It just broke its 40 day trough low over earnings, and any upmoves should have a 5 day VTL drawn on the lows of price. Then when it breaks the VTL next week, short trades can be done. Target is $83 to $87 dollars. Its in the consumer discretionary sector. Rising rates seem to be affecting Carmaxxxx. 😂

ZBRA 0.00%↑ short

Its an info tech company is having a big downtrend since last year. It has not been able to make a 40 day cycle projection up, recently, and appears to be hovering around the bottom of a 10 day trough, looking really weak. Any sell off in High PE stocks is putting this one in the crosshairs for a move to $380 or below. The trendline is not a valid trendline, but any move below $400 is probably going to be met with selling as it wants to get into the second half of April to see its 40 day trough, probably at a lower price. It is going to bounce if the market does well, so drawing your own 2.5 day VTL and alerting to a price cross may produce a short trade. Resistance is at $420.

Trading Advisor Column: Community experts weigh in on their trading journey

My best attempt to appeal to traders and investors to listen to a story that inspires them. I will feature regular guests for written interviews as soon as the readers send me their interests and what they would love to talk about with the group. You can be featured! Let me know in the comments or email me back. I want to interview Trading Advisors for each weekly episode!

This week I want to discuss talking to other traders as a sport. You have to talk to other traders. I think teamwork is super important. Go and build your own facebook group or a distribution email list at work with private access only for people that want to learn how to trade. Get in there and teach them these concepts that you're learning. The only way to really grow is to teach.

If you are already a professional, why not try to teach our Advised Trader readers something? I'd love to talk to you for a short, written newsletter interview, so, if you regularly read the newsletter and love the content, please let me know if you can tell us about your trading or something of value. We are trying to build a community of followers that turn to leaders and leaders that turn into something much bigger than themselves.

I started to talk to Alex from MacroOps, hopefully it pans out. I think they have some good timely analysis for CFA type stuff. Kind of like research and it seems like they keep a good handle on current trade ideas. We're gonna catch up soon. Their offering is up at https://collective.macro-ops.com/join-now. I would recommend anyone take a look at their stuff. I would love to tell you more, but I think Macro-Ops has their hands full with their service right now, I hope to have something to show you soon. I really like their insights and tone for traders.

Entrepreneurs to know about: I share my favorite resource of the week from someone cool in an around the industry

Whose mission or product is great and helps people actually change their lives? That's the focus of this section. I want to bring awareness to leaders and thoughtful people that are doing work that makes an impact on the space of trading and for traders that are just learning how to get to work with technology, studying the market or doing work in the field that is for discretionary and automatic trading.

I want to feature Lars von Thienen for his work in cycles over the last 10 years. He is an influencer in the software and math area of cyclical analysis. He has books and does a good job over at TradingView, which is a great place for his work to be showcased. I might have to get over there pretty soon. Check out Lars and see if you like his stuff. I personally think from what I've seen of Lars, he would be a great person to have on a team of traders. I don't personally know him, but I think he is friendly and would probably take my call. His YouTube is good.

Big Value Stocks: Where to look for value in a bear market?

Here, I ask a trader with experience, such as a CFA to feature a stock insight for us to look at. The idea is to find stocks that are in growing sectors that are still cheap.

This week I am going to do the analysis and pick a stock since I don't yet have word back from a CFA to feature here, Larry Cheung. He is a great guy, always has good stuff on his YouTube page. He talks about things that will blow your mind. The depth of knowledge and energy he has shown on his videos is amazing. He really does good analysis and will teach you something. I think he will be featured soon for this section if I can get him to contribute… 72000 subscribers and growing, he's doing real good at finding traders that will listen.

I imagine he has alot of different people watching his stuff. He will have 1 million subs soon. I warned him recently about $BABA capitulation below $100 and I think he was also concerned, as I got an email the next day about it. Anyways, I still think $BABA is going to $20, Larry!

So, on to the selection of a stock that is under $50 dollars that will withstand price shocks in the indexes. OIL/GAS is the industry. I’ll pick two for you, $WES or $DCP. I like them both. The space is open for new customers when the war is over in Ukraine and for rebuilding supplies across the world after COVID19 has officially ended. I mean, we can get more interesting and talk about fundamentals, but Ill save that and just do a cyclical analysis, instead.

Both $DCP and $WES are within 1 year or more of their 54 month cycle peaks. They are both bouncing out of very healthy 20 week and 40 week cycles it seems. They can be expected to be resistant to any price shocks or slow walk down bear markets in indexes like we see today.

Hey, if this email has done you any good, please send it to someone and remember, Advised Trader is free to join. And it has a cool author.

Thanks,

Until next week!

Derek Frazier

QUICK DISCLAIMER: “My suggested entries and targets for trades here on Advised Trader, are that which I will set for my own trading and it's not advice to enter or exit for any of my readers. I am not a registered investment advisor or commodity trading advisor and we don't have a professional relationship of any kind. All material is merely to learn and to entertain the reader.”