Probable 20 week (maybe 40 week) duration cycle peak in 10 year yield futures... oil and financial confirming

running successfully at 127 days with predictable shorts

The most recent downmove in the 10 year yield futures is probably due to reaching a large peak, maybe 40 weeks in duration, meaning, a large peak… or you could say that weakness is due to falling thru the 40 week FLD. And Hurst analysts would be correct to point out that we are due to target the golden box below based on the projection of said FLD.

You dont have to know what it means because you expect at least a 20 week peak and that downmove through that 20 day FLD shown below.

When both the financials and energy sectors are dropping, you can expect a nice move down in 10 year yield futures, am I right? lol

See guys it doesnt take a genius to figure this out guys.

I was a specialist in the Army guys.

So, yeah.

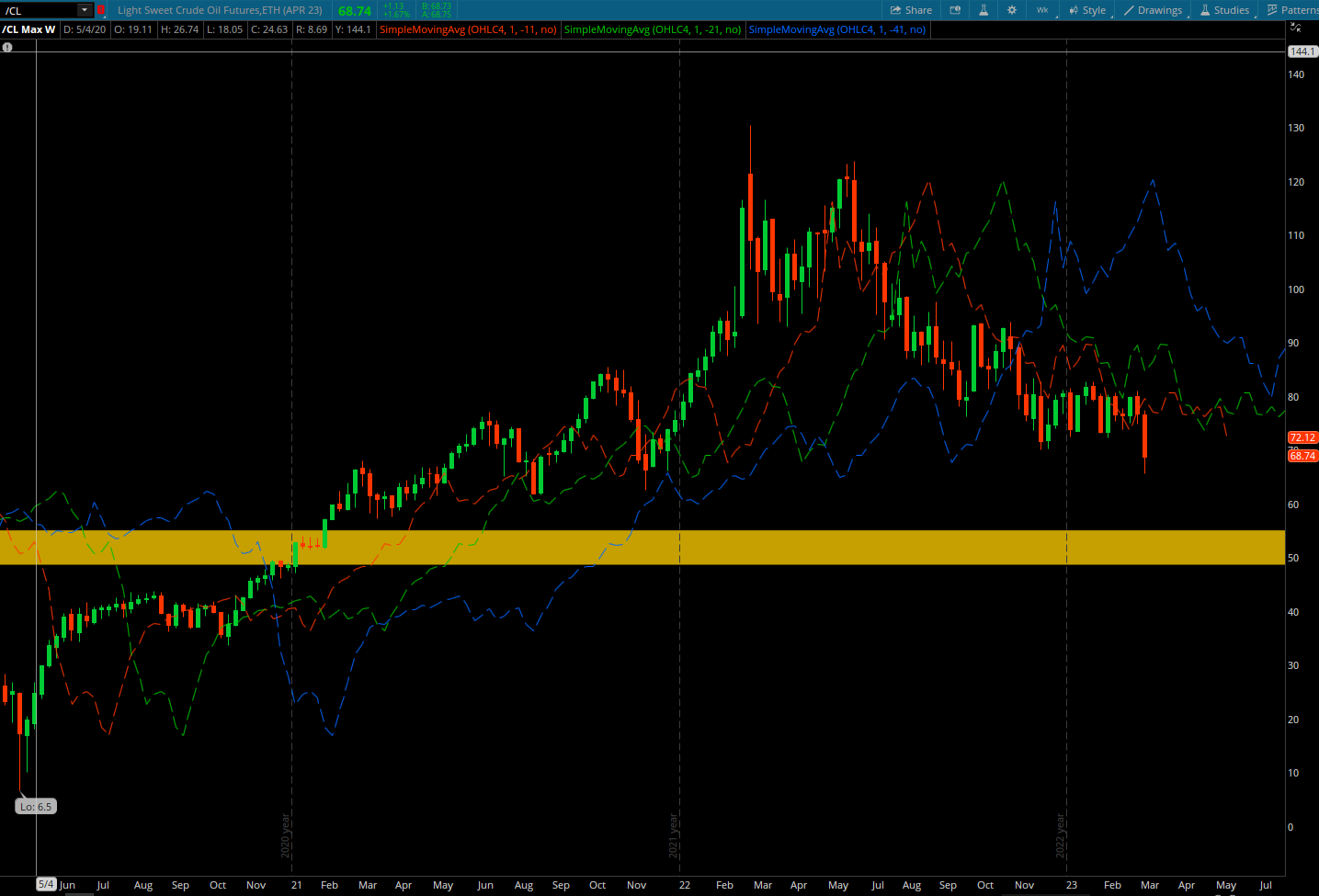

Ummm, If we look at the Oil chart we see support coming in, but I think that gets filled in, dont you? Especially if Hurst analysts are seeing that 80 week FLD projection getting filled to $50 (Blue line price cross from peak, here, 130-90 = 40, so projection down is 90 - 40 = 50, get it?). That would be a huge downmove, it would also be very hurtful to Putin.

Its probable that the 80 day up-trending VTL was ALSO broken and the resulting move lower will be a continuation of bear market to $50 in oil.

Regarding financials. Theyre down.

So, I think thats it for today, I hope you enjoyed the lesson.

Derek

###