In this post I said the Mexican Peso carry trade was ending and it still is, but I was 60 days early. The Fed had something to do with it. Looking at rates over the years, they make a drastic peak, and move down abruptly over the resulting QUARTERS.

So this is a long term trade.

Anyways, the thing is, its happening NOW since the US market has turned around on a dime and is expected to rally if it truly is a new 80 week cycle.

The carry trade, BTW, is when you prefer to sit your money with the highest yielding FX like the Peso. But its not really a big deal to identify it. We have to trade it.

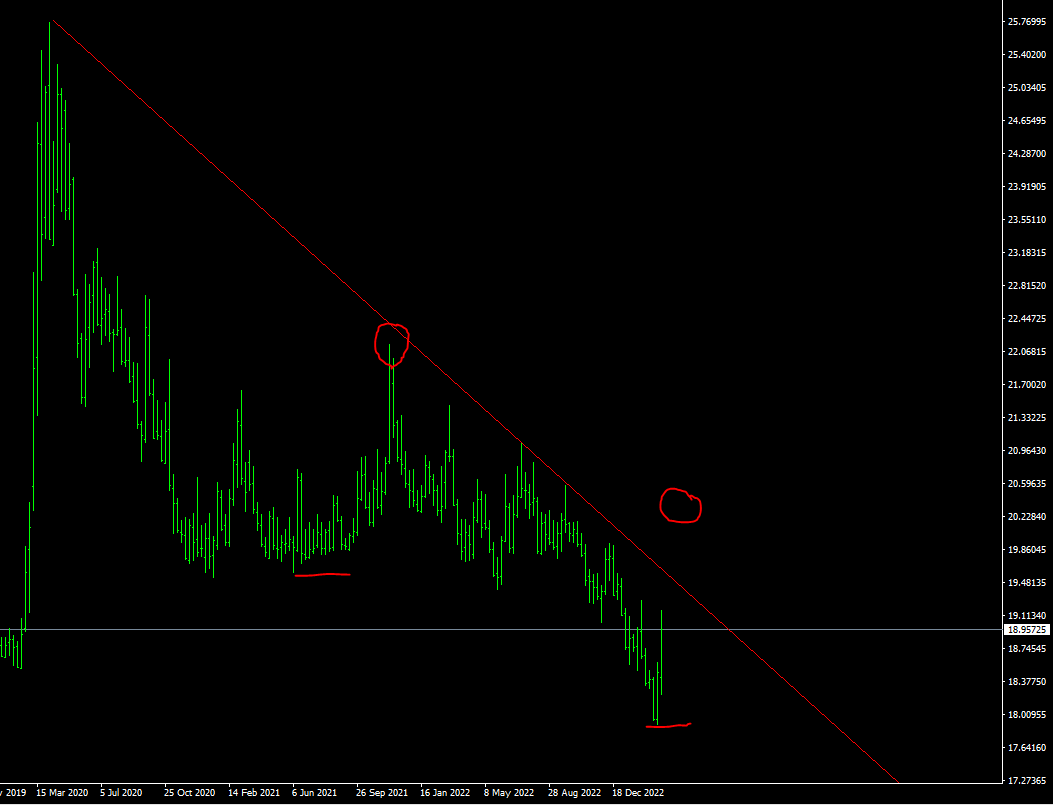

There exists potential to move into 22.50 as the peak of the 80 week cycle is pulling up the dollar against the Peso here. But whats makes this so powerful, folks, is the 80 week cycle pushing up against the Peso here as well. Hurst analysts see the VTLs above. See the chart for cycle bottoms and tops. EZ stuff.

The idea is to keep thinking about rates dropping in MEXICO while the US stays the same or raises their rates slightly higher… (safer debt)… and the carry trade will continue to fizzle out as investors realize double digit rates are unsustainable for long.

Also.. you know, people are getting deeper into rates in the US, earlier; investors are very wary in March of 2023.

dont miss a post!

SINCERELY,

DEREK

1354 CST Mar 15 2023

####

edit: 18:46 cst March 31 2023

recent rise in rates in Mexico could signal end of trend, check comments, and leave a like please

Edit: 1745 CST May 3 2023

PEMEX profits plummet on subsidiarios on consumer prices.